Free Stock Average Calculator – Calculate Stock Average Price

Stock Average Calculator

Average Stock Price: 0

A Stock Average Calculator is a tool that helps buyers find the average price of the stocks they own. Putting in the purchase prices and the number of shares bought at different prices makes it easy for investors to quickly find the average cost per share. It helps to make smart choices about buying, holding, or selling stocks.

Enter Purchase Details:

Input the number of shares and the purchase price for each transaction. Do this for all the different times you’ve bought the same stock.

Calculate Average Price:

The calculator will add up the total cost of your purchases and divide it by the total number of shares to give you the average price per share.

Review Results:

Look at the calculated average price to make informed decisions about your stock portfolio. Compare this average with the current market price to decide your next move.

Investing in the stock market can be both exciting and challenging, especially when trying to keep track of various stock prices and market changes. One basic yet crucial concept for any investor is calculating the average cost of stocks. This is where Stock Average Down Calculator comes in handy. It’s a simple yet powerful tool that helps investors get a clear picture of their average stock prices, making portfolio management much easier.

Why is Calculating the Stock Average Important?

Better Decision-Making: Knowing the average price of your stocks helps you decide if the current market price is a good deal for buying more shares or if it might be time to sell.

Portfolio Management: Keeping track of your average stock prices helps you manage your investments better, ensuring a balanced and diversified portfolio that maximizes returns and minimizes risks.

Tax Purposes: Calculating the average cost of your stocks is important for accurate tax reporting. It helps you correctly report capital gains or losses, which can save you money on taxes.

Performance Tracking: By monitoring the average prices of your stocks, you can evaluate how well your investments are doing. It gives you a clear benchmark to measure the profitability of your trades.

Cost Analysis: Using a stock average calculator allows you to perform a detailed cost analysis of your investments. By understanding the average price of your holdings, you can assess whether your investment strategy is cost-effective. This helps you identify opportunities to reduce costs, optimize your buying strategy, and ensure you’re not overpaying for stocks. A clear cost analysis also empowers you to make informed decisions about future investments, ensuring you stay within your budget while maximizing potential returns.

Time-Saving: Manually calculating the average price of your stocks can be time-consuming, especially if you have multiple transactions or a diverse portfolio. A stock average calculator automates this process, saving you valuable time and effort. With instant and accurate calculations, you can focus on analyzing market trends and making strategic decisions rather than getting bogged down by complex math. This efficiency benefits active traders and investors who need quick insights to capitalize on market opportunities.

Why Choose Our Tool?

Our reliable average stock price calculator has the following salient features:

Easy-to-Use Interface:

A simple design that makes it easy to use and quick to get results.

Multiple Entries:

The ability to handle various stock purchases with different prices and quantities.

Accuracy:

Precise calculations to ensure you can trust the results.

The Stock Average Calculator is an essential tool for investors, no matter how experienced you are. It makes it easier to make informed decisions, manage your portfolio more efficiently, and stay on top of market trends. Whether you’re an experienced trader or new to investing, using a Share Average Calculator can really boost your investment strategy and financial success.

Stock Market Heatmap

See the current scenario of the stock market at a glance.

Understanding Cost Basis

When calculating stock averages, cost basis plays a pivotal role. Cost basis refers to the original value of an asset for tax purposes, generally the purchase price, adjusted for factors like stock splits and reinvested dividends. This metric is vital in determining capital gains, which are the profits earned from selling an asset. Accurate calculation of cost basis ensures proper tax reporting, helping investors avoid overpaying taxes.

Definition:

The cost basis represents the initial price paid for an asset, including any related fees or commissions.

Capital Gains:

The difference between an asset’s sale price and its cost basis is the capital gain, which is subject to taxation.

Adjustment Methods:

Investors can use methods like Average Cost, FIFO (First In, First Out), or LIFO (Last In, First Out) to calculate the cost basis, each with varying tax implications.

Real-Life Example:

Consider an investor who buys shares worth $1,000 and reinvests $300 in dividends. The adjusted cost basis becomes $1,300. When the shares are sold for $1,500, only $200 is taxable gain, compared to $500 if the dividends were not factored in.

Special Situations:

- Stock Splits: These alter the per-share cost basis without changing the total investment value.

- Gifted/Inheriting Shares: Gifted shares retain the original owner’s cost basis, while inherited shares adopt their market value at the time of inheritance.

Why It Matters:

- Accurate cost basis tracking is essential for calculating stock averages and managing tax obligations effectively. Missteps can lead to overpayment or non-compliance. Investors should maintain thorough records and consult financial advisors for complex scenarios.

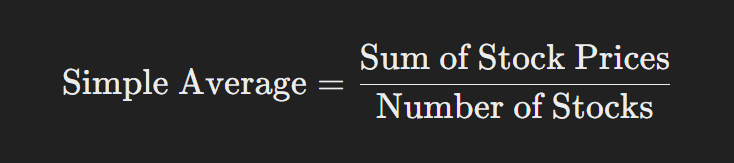

What is the formula of Stock Average?

According to Investopedia, the formula for calculating stock averages is as follows:

Simple Average =Sum of Stock Prices / Number of Stocks

Other Stock Average Formulas are:

Price-Weighted Average (like the Dow Jones Industrial Average):

Price-Weighted Average= Sum of Stock Prices (adjusted for stock splits) / Number of Stocks

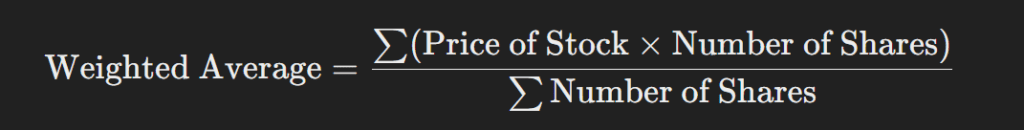

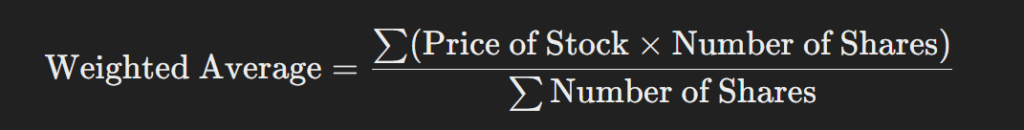

Weighted Average:

Weighted Average= ∑(Price of Stock×Number of Shares) / ∑Number of Shares

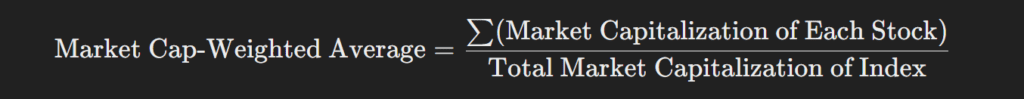

Market Capitalization-Weighted Average (like the S&P 500):

Market Cap-Weighted Average= ∑(Market Capitalization of Each Stock) / Total Market Capitalization of Index

Example of Averages

For now, I am taking the example of Tesla shares.

Example Stock Prices for Tesla (TSLA)

| Date | Closing Price |

|---|---|

| Jan 1, 2023 | $120.00 |

| Jan 15, 2023 | $130.00 |

| Jan 30, 2023 | $140.00 |

| Feb 15, 2023 | $150.00 |

| Feb 28, 2023 | $145.00 |

Calculating the Average

The sum of Closing Prices:

- $120.00 + $130.00 + $140.00 + $150.00 + $145.00 = $685.00

Number of Closing Prices:

- 5

Average Price:

- Average = Total Sum / Number of Prices

- Average = $685.00 / 5 = $137.00

Result

- Average Closing Price of Tesla (TSLA) over the selected period: $137.00

Try out our Stock Average Down Calculator today and start making more informed investment decisions!

Today's Stock Market Overview

See the day’s top five gaining, losing, and most active stocks. The list updates based on current market activity, so you’ll always see the most relevant stocks.

Frequently Asked Questions

Find top questions that will help you find what you are looking for.

Stock averaging (also Average Down Calculator), also known as cost averaging or dollar-cost averaging, is a strategy where you calculate the average cost of a stock based on multiple purchases made at different prices. This helps you determine the overall price you’ve paid for your shares and track your investment’s performance over time.

Our stock average calculator lets you input the number of shares you’ve purchased at various prices and dates. The tool then calculates your average purchase price per share, giving you a clear picture of your investment’s cost basis.

Using a stock averaging calculator helps you understand your overall investment cost, track your spending over time, and assess whether you’re making a profit or loss. It can also help you plan future investments by identifying opportunities to buy at better average prices.

To use the calculator, you’ll need to provide the following details for each purchase:

- The number of shares bought.

- The purchase price of the stock at that time.

The results are highly accurate, as the calculator uses a straightforward mathematical formula to compute the average cost of shares purchased. It ensures that all data entered is processed precisely to provide the correct average.

Yes, you can calculate average stock prices for foreign stocks or international markets. Simply add the buying prices and total costs, and click the calculate button.

Yes, you can use this calculator to calculate your crypto averages.

Explore our other tools

Try other advanced tools to Boost your productivity.

Our Latest Blogs

Being informed allows you to assess risks better, make strategic decisions, and respond to market fluctuations in a more knowledgeable way.

What are the Top 5…

Investors always strive to comprehend and anticipate market movements in the complex and ever-changing stock market. Various indicators have been developed to provide insights into market trends, investor sentiment, and…

Exploring All Types of Stocks…

Investing in the stock market is a popular way to build wealth and achieve financial goals. However, understanding the basics of stocks and how they operate is crucial for anyone looking…

How to Use a Stock…

Navigating the stock market can frequently be like traversing a labyrinth with limitless twists and turns. The fluctuating costs, financial indicators, and corporate news create an environment that demands seasoned investors.…

How to Calculate Stock Averages?

In phrases of investing, know-how to calculate stock averages is an essential talent that may significantly affect your investment strategy and economic success. Stock averages offer treasured insights into the performance of…

3 Proven Stock Investment Strategies…

Getting started in the stock market can be an exciting yet challenging experience, particularly for those new to it. Regarding stock investing, novice investors must approach it with well-informed strategies…

Day Trading Plan

To build a profitable day trading plan, it’s crucial to understand the fundamentals of day trading. This section will provide a comprehensive overview, laying the groundwork for more advanced topics.…